Overview

This guide explains how Monthly Recurring Revenue (MRR) is calculated in ClearSync. Understanding these calculations helps you better-interpret your financial reports.

MRR in ClearSync

Monthly Recurring Revenue (MRR) represents how much recurring revenue your business generates from subscriptions, expressed on a monthly basis. Once implemented, in HubSpot:

- CLS Stripe Subscriptions tells us the current MRR for a given subscriber as of the moment you’re looking at a record or running a report.

- CLS Stripe Events represent a record of every change to a Subscription’s MRR, giving us insight into how MRR changes over time.

Key Concepts

- Billing Periods: All billing periods (weekly, monthly, quarterly, annual, custom, etc.) are interpreted automatically to reflect effective MRR amounts. One-time charges are not considered.

- Discounts & Coupons: Any coupons or discounts are automatically factored into ClearSync’s MRR calculations.

- Intent to Pay: ClearSync recognizes MRR for customers who have been invoiced for a subscription but have not yet paid or canceled.

- If a customer subscription is created and is billed, but the new customer never pays:

- 1 CLS Stripe Subscription record in HubSpot will still be created

- 2 CLS Stripe Event records in HubSpot will be created:

- One record is categorized as New revenue for the initial MRR

- One record is categorized as Cancelled revenue for non-payment once the Stripe subscription is fully canceled

- Excluding taxes and fees: Tax amounts and Stripe fees are not included in MRR calculations

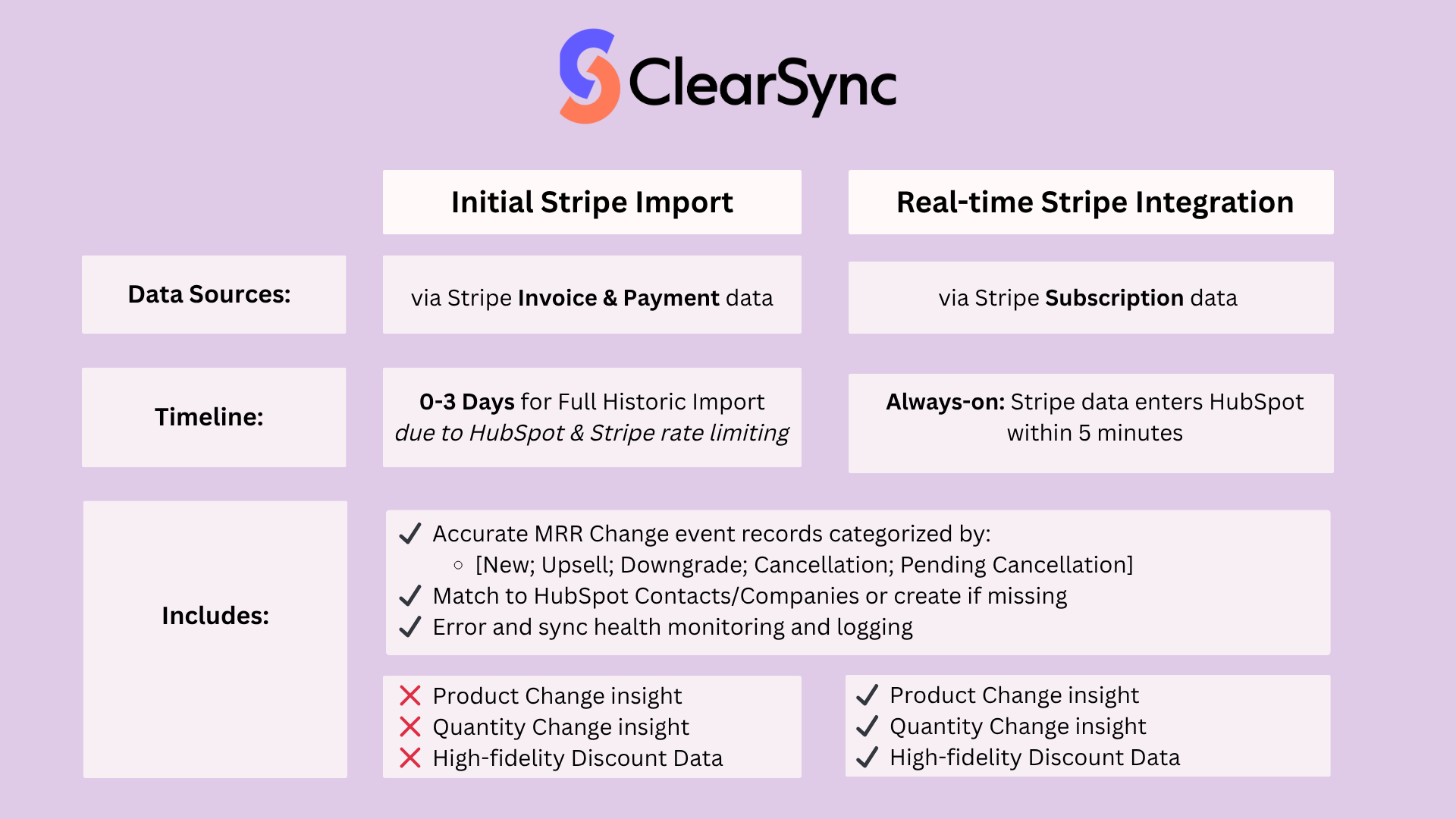

Initial Historical Stripe Import vs Real-time Stripe Data:

- Note on Discounts for the Initial Stripe Import: Due to Stripe limitations, if a discount was applied mid billing-cycle (e.g. as part of a prorated upgrade), ClearSync’s MRR calculation will recognize that discount for the entire billing cycle.